A Principal Mining Holding Company Building and Owning Strategic Assets

We deploy capital, technical leadership, and operational control through subsidiary project companies to acquire, incubate, and advance mining assets across multiple jurisdictions.

Group Overview

Holding Company Overview

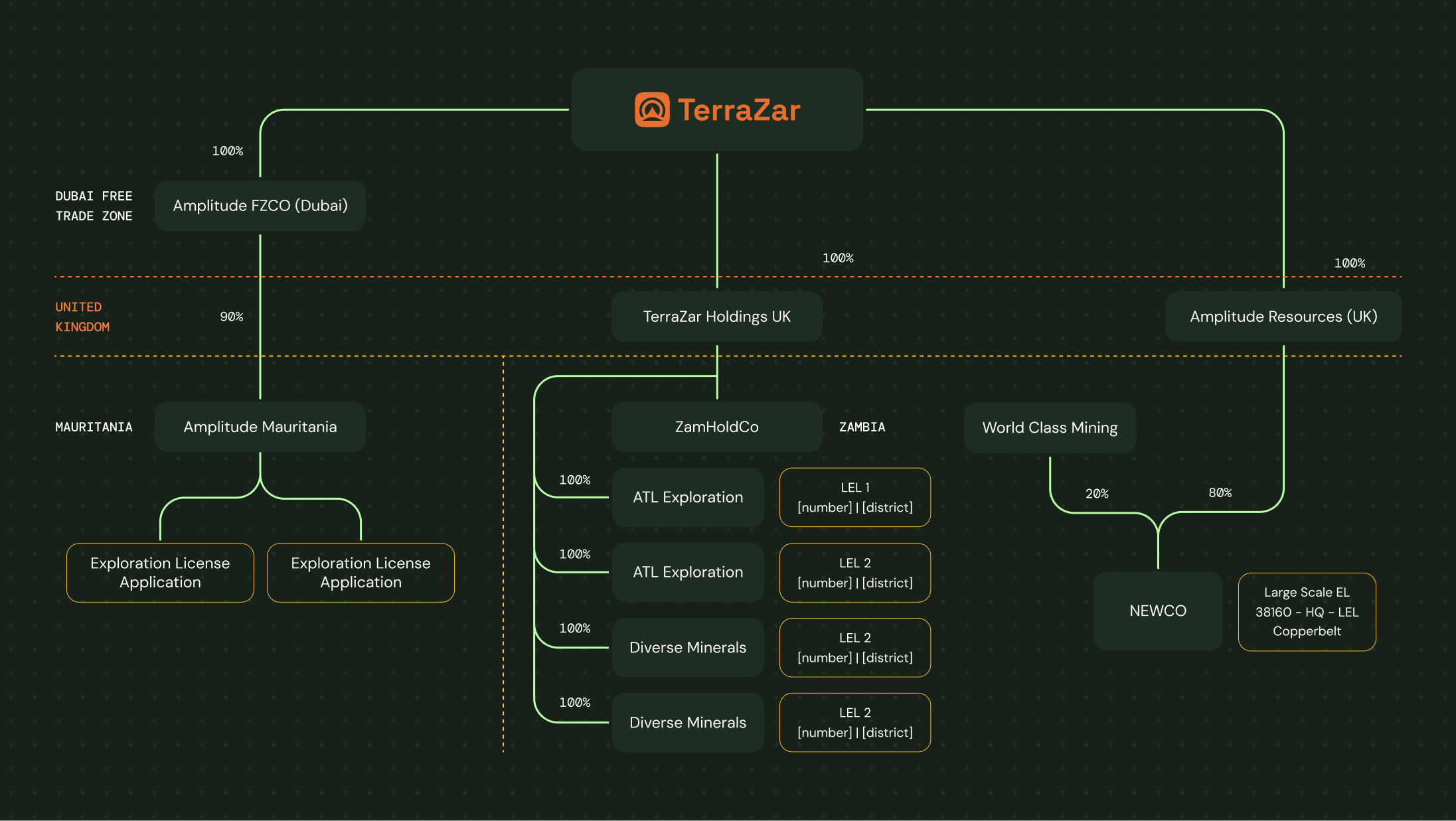

TerraZar Resources is the group holding company for a portfolio of mining assets and project companies operating across Africa and other frontier and established jurisdictions.

The group structure enables disciplined capital allocation, jurisdictional risk segregation, and long-term value creation at the parent company level.

Group Structure

Each mining project is held within a dedicated project company, allowing for targeted funding, local partnerships, and jurisdiction-specific governance while preserving control at the TerraZar parent level.

Capital & Value Creation

TerraZar's strategy is to create long-term equity value through asset incubation, disciplined dilution, strategic partnerships, and capital structuring at the project level

Marcel Nally

As the group's lead architect and capital allocator, Marcel Nally focuses on structuring, acquiring, and advancing TerraZar's proprietary asset portfolio. A proven asset builder, he previously co-founded Moxico Resources, driving its growth from inception to a valuation exceeding $1 billion.

Marcel leads the group's investment strategy, applying the rigorous frameworks he developed as the author of The 8 Pillars of Starting a Mining Company and as the founder of Minestarters, a mining finance platform integrating digital capital solutions.

Portfolio/Assets

The TerraZar portfolio consists of early to development-stage mining assets acquired and advanced through disciplined technical and capital allocation processes.

Moxico Resources

Co-founders

Role in capital strategy and project development supporting growth to a +$1B valuation.

Tertiary Minerals

JV Structuring

Project generation enabling partnership formation.

Amplitude Resources

Capital Raise and Project Execution

Investment contributing to project financing and execution.

Group Capabilities

- Capital Allocation & Structuring: Deploying proprietary balance sheet capability and structuring project-level funding optimized for asset maturity.

- Resource Development: Internal geological intelligence and standards-based reporting to drive resource expansion across the portfolio.

- Project Execution: Direct operational management of exploration programs, ensuring seamless advancement from discovery to development readiness.

- Strategic Governance: Active management of joint ventures and subsidiary partnerships to maximize equity value.

- Technical Integration: Aligning geological reality with commercial strategy to de-risk portfolio assets.

Leveraging deep internal expertise to drive principal value from concept to commercial success.

Strategic Mining Capital

Engage with TerraZar to explore strategic partnerships, asset-level opportunities, and long-term value creation.